Connect Corporate Centre, Sydney NSW

Over the last five years, AMP Capital has acquired more than $1.3 billion worth of quality commercial real estate on behalf of investors in the AMP Capital Wholesale Australian Property Fund (WAPF).

In this article, we provide some insights into what we believe makes a quality asset, how to go about executing a transaction and ensuring assets are effectively managed to deliver the best value for our clients.

1. Be clear on your objective and risk appetite

Real estate investment has many facets. At one end of the spectrum there are the ‘thrills and spills’ of development where investors take on a lot of risk often on a single deal to generate returns. This requires a prudent risk management approach and is not for everyone.

Coming down the risk curve, traditionally residential property has offered solid long-term capital gains, but very little income along the way. And for a growing number of Australians – particularly those moving into retirement – investing in commercial property is attractive for the higher income yield it potentially offers.

WAPF aims to cater to this need by holding a diversified portfolio of good quality Australian office, retail and industrial properties.

2. Look for assets with high-quality tenants

For generations, Australian institutions have been attracted to commercial real estate for its secure income stream. Leases to corporate and government tenants typically run from three to ten years and include fixed annual increases in the rent. So as long as the tenant is solvent, the rent legally needs to be paid each month – year-in, year-out.

WAPF aims to invest in properties that will attract good quality tenants from a wide range of industries.

3. Look for assets with a high-quality offer – location, space, customer service

High-quality tenants want a high-quality offer: Properties in great locations; physical spaces that work for their businesses; and excellent customer service from their landlord and property manager.

Getting this right helps to keep occupancy rates consistently high which in turn maintains the rent available to investors. By way of example, Connect Corporate Centre offers contemporary space which has been architecturally designed to meet the modern needs of tenants.

We also take great pride to deliver quality customer service to our tenant customers and build on these relationships over multiple lease terms.

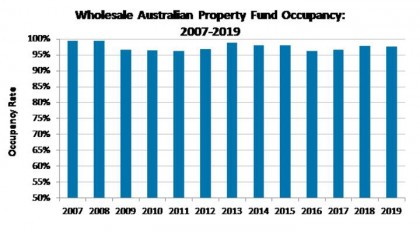

This has contributed to the Fund maintaining an average occupancy rate of +97 per cent over the last 10 years.

Past performance is not a reliable indicator of future performance.

4. Diversification across sectors and tenants

Diversification also helps to reduce risk. This might sound like a cliché, but that doesn’t make it any less true. WAPF aims to hold a portfolio which is diversified in terms of the number of properties it holds, the markets in which these properties are located, and the variety of tenants and the industries in which they operate.

With a portfolio valued at more than $A2 billion*, the Fund has the scale to own shopping centres, office buildings and industrial facilities in major metropolitan markets across Australia. Assets which have a rent roll of over 20 tenants such as Connect Corporate Centre, typically provide strong rental growth prospects. There are also over 350 tenants currently in the portfolio, and none individually account for more than 5 per cent of revenue.

5. Executing on an investment decision

Investing in real estate may not seem like rocket science but making the right decisions and then being able to execute is harder than it looks.

The right property needs to be available at the right time, at the right price. This takes a team with a wide range of skills and excellent market relationships to first buy it, and then manage it, in order to derive value for investors. Off-market transactions are generally only possible through long-standing relationships. Even then, there is often a lot to consider.

For example, buying a brand new property requires a deep understanding of the construction and development process, numerous legal agreements to be negotiated, meticulous tax advice, and of course, a solid research foundation backing up the decision to invest.

Last – but by no means least – the Fund needs to be able to fund the transaction which is possible thanks to the Fund’s debt facility which in the case of WAPF, is set at a conservative target range of 0-15 per cent, consistent with its conservative risk profile.

What’s next for WAPF

Over the last few years, WAPF has seen strong support from investors wanting a better income return than they can get from bank deposits (and willing to take the added risk that goes with this). Thanks to this support, the Fund has continued to grow its investment portfolio to 26 properties valued at over $2 billion.

There is no standard template for a successful property transaction. Each opportunity requires a lot of time and research to find and understand, and a combination of different skills, relationships and experience to execute and subsequently manage to deliver value.

With the backing of a fully integrated real estate management team which has 60 plus years’ experience sourcing, investing in, managing and developing real estate through different market cycles, WAPF is in a strong position to continue to welcome new quality assets to the Fund’s portfolio and the hunt now goes on for the next successful investment.

It’s important to be aware that there are risks associated with investing in the Wholesale Australian Property Fund. Before investing, please read the Product Disclosure Statement which can be found by visiting our website.

*Gross Asset Value (GAV) as at 30 June 2019

Important Information: Investors should consider the Product Disclosure Statement (PDS) available from AMP Capital Investors Limited (ABN 59 001 777 591) (AFSL 232497) (AMP Capital) for the Wholesale Australian Property Fund (Fund) before making any decision regarding the Fund. National Mutual Funds Management Ltd. (ABN 32 006 787 720, AFSL 234652) is the responsible entity of the Fund and the issuer of units in the Fund. The PDS contains important information about investing in the Fund and it is important investors read the PDS before making a decision about whether to acquire, continue to hold or dispose of units in the Fund. Neither AMP Capital, nor any other company in the AMP Group guarantees the repayment of capital or the performance of any product or any particular rate of return referred to in this document. Past performance is not a reliable indicator of future performance. While every care has been taken in the preparation of this document, AMP Capital makes no representation or warranty as to the accuracy or completeness of any statement in it including without limitation, any forecasts. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objective s, financial situation or needs. Investors should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to their objectives, financial situation and needs.

Author: Christopher Davitt, Portfolio Manager – Real Estate Sydney, Australia

Source: AMP Capital 16 August 2019

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.