Shane Oliver

Superannuation is locked away for a reason, it is a long-term investment. That simple fact can be hardest to accept when markets are in turmoil and balances are taking a hit, but in our view, history works in favour of applying a long-term lens when everyone is heading for the exit.

Anyone could be forgiven for thinking an argument for holding your ground with superannuation during this period of turmoil is marketing spin. Similarly, the urge to flock to ‘safe’ assets like cash is understandable, as equities exposures in superannuation portfolios take a hit.

However, as we’ve now been reminded, growth assets like shares have always had periods of bad short-term performance versus bonds and cash. But in the long-term, they can provide superior returns, which is a key component of growing retirement savings.

These arguments may seem like the 101s of investing that don’t need explaining, but when times are tough, even the basics can feel challenging. It’s periods like this which put investors to the test in the short-term, and when rational thinking is needed to best preserve long-term goals.

This piece focuses on our views about the accumulation/growth phase – for those in or near retirement, goals and circumstances are different.

1. The power of compound

Superannuation is aimed (within reason) at providing maximum (risk-adjusted) funds for use in retirement. Typically, Australian super funds have a bias towards shares and other growth assets that grow in value with the economy, particularly for younger members, and some exposure to defensive assets like bonds and cash to avoid excessive short-term volatility. These approaches aim to make the most of the power of compound interest which sees returns build on returns over time.

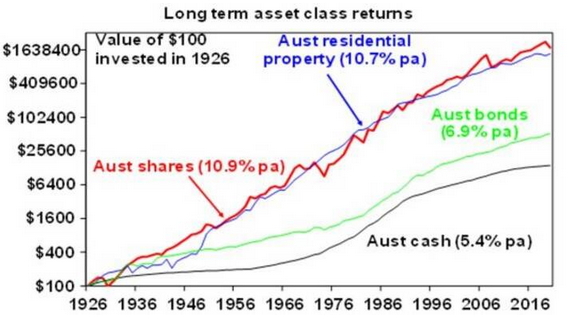

The below chart shows the value of a $100 investment in Australian cash, bonds, shares and residential property from 1926 assuming any interest, dividends and rents is reinvested along the way. As return series for commercial property and infrastructure only go back a few decades I have used residential property as a proxy.

Sources: ABS, ASX, Bloomberg, REIA, AMP Capital

Over the period shown since 1926 cash has returned 5.4% per annum, bonds 6.9% pa, property 10.7% pa and shares 10.9% pa. Because shares and property provide higher returns over long periods, the value of an investment in them compounds to a much higher amount over the long term.

So, it makes sense to have a decent exposure to shares when saving for retirement. The higher return from shares and growth assets reflects compensation for the greater risk in investing in them – in terms of capital loss, volatility and illiquidity.

2. Turn down the noise

On a day-to-day basis, shares are down almost as much as they are up. But if you just look monthly and allow for dividends, the historical experience suggests you will only get bad news in the form of a negative return around a third of the time. If you go out to once a decade, positive returns have been seen 100% of the time for Australian shares and 82% for US shares.

So while it’s hard given the bombardment of information, misinformation and financial news these days, it’s prudent to be conscious of the rash decisions you can make based on short-term bad news. And remember: it only takes 24 hours for a bad day in markets to be yesterday’s news.

Daily and monthly data from 1995, years and decades from 1900. Sources: Bloomberg, AMP Capital

3. Wealth takes time to build

The temptation for short-term trades is immense when there’s blood on the streets. In these cases, it’s important to remember that wealth takes time to build (except in rare cases!) and short-term moves can work against that guiding principle. Also, short-term jumps work on the assumption that an investor can time the market.

With the benefit of hindsight many swings in markets like the tech boom and bust, the GFC and, maybe in the years ahead, the current episode look inevitable and hence forecastable and so it’s natural to think “why not give it a go?” by switching between say cash and shares within your super to anticipate market moves. Fair enough if you have a process and put the effort in.

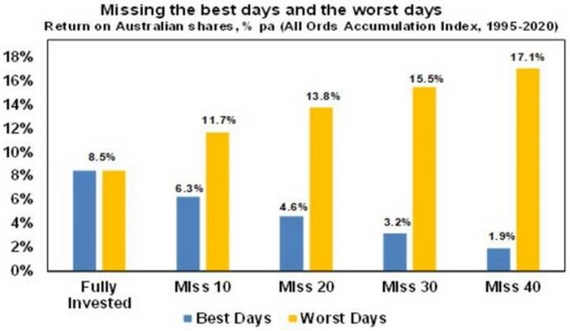

However, without a tried-and-tested market timing process, trying to time the market is difficult. A good way to demonstrate this is with a comparison of returns if an investor is fully invested in shares versus missing out on the best (or worst) days. The next chart shows that if you were fully invested in Australian shares from January 1995, you would have returned 8.5% pa (with dividends reinvested but not allowing for franking credits, tax and fees).

Sources: ASX, Bloomberg, AMP Capital

If by trying to time the market you avoided the 10 worst days (yellow bars), you would have boosted your return to 11.7% pa. And if you avoided the 40 worst days, it would have been boosted to 17.1% pa! But this is not easy as many investors only get out after the bad returns have occurred, just in time to miss some of the best days. For example, if by trying to time the market you miss the 10 best days (blue bars), the return falls to 6.3% pa. If you miss the 40 best days, it drops to just 1.9% pa.

In short

This is undoubtedly a stressful time for anyone watching the shares in their portfolio at the moment. But just as looking back on the GFC showed that some panic-selling and flocking to cash ultimately sacrificed future gains,1 this period of time in the market may again show that holding your nerve and keeping eyes on the long-term prize was a more sensible way through.

Author: Dr Shane Oliver, Head of Investment Strategy and Economics and Chief Economist, AMP Capital Sydney, Australia

Source: AMP Capital 13 May 2020

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.