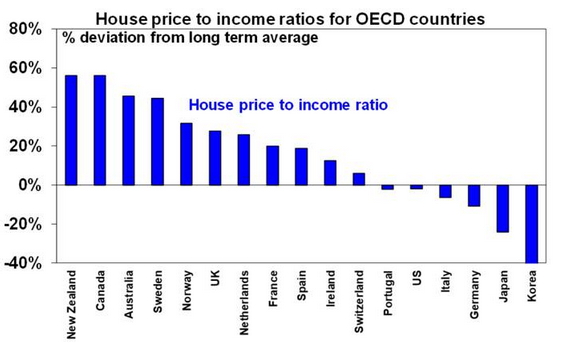

For years Australia has suffered from poor housing affordability. According to the 2020 Demographia Housing Affordability Survey the multiple of median house prices to median annual incomes is 5.9 times in Australia compared to 3.9 times in Canada, 4.5 times in the UK & 3.6 times in the US. Consistent with this the ratio of house prices to incomes relative to its long-term average is at the high end of OECD countries.

Source: OECD, AMP Capital

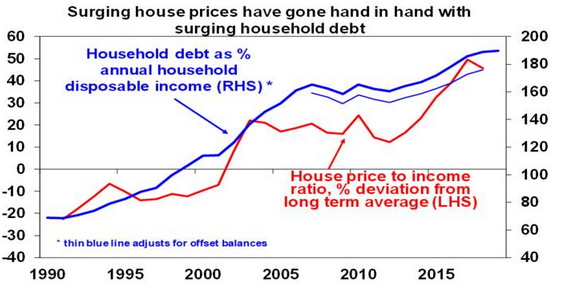

It wasn’t always so – Australia was once seen as a country with relatively cheap and affordable housing. Having a house on a quarter acre block was an essential part of the “Aussie dream”. But that changed last decade as average house prices went higher and higher relative to average incomes and this went hand in hand with a surge in household debt relative to income. See the next chart. There have been several cyclical downswings in property prices that have brought short term relief in terms of affordability – around the GFC when average capital city dwelling prices fell 7.6% based on CoreLogic data, around 2011 when prices fell 6.2% and in 2017-19 when prices dipped 10.2% – but they have been short lived with prices quickly bouncing back.

Source: OECD, AMP Capital

The coronavirus shock may have a more lasting impact. It has brought lots of pain and suffering on a human level but also on an economic level. And it has caused much disruption to the property market in the short term with more likely to come. But it may have a lasting positive legacy in relation to property – that is more affordable housing in Australia.

Why is Australian housing so expensive?

To understand why this may be the case its necessary to consider what has caused poor housing affordability in Australia in the first place. It’s been popular to blame tax concessions, foreign buying, government related housing infrastructure charges and stamp duty and low interest rates and easy credit. But none of these really explain it.

Lots of other countries have a variety of housing tax concessions too, but with much cheaper housing. Foreign buying is a relatively small part of the overall market and has declined in recent years. Infrastructure associated with housing is hardly unique to Australia. Stamp duty adds to the cost of transactions and is a silly tax, but if anything may have kept prices lower than they otherwise would be (when supply is constrained). The shift from high interest rates to low interest rates enabling bigger loans has enabled ever more expensive housing – but other countries have also seen ultra-low interest rates in recent decades and yet have much cheaper housing.

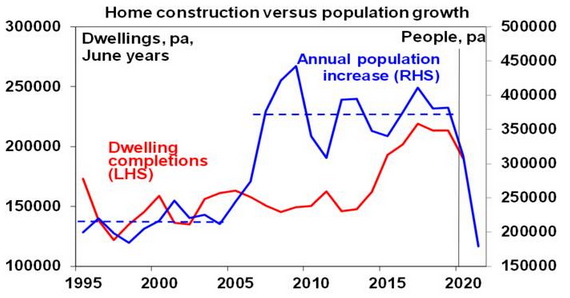

Rather the basic problem has been a surge in population growth from mid-last decade and an inadequate supply response (thanks partly to tight development controls and lagging infrastructure). Since 2006, annual population growth averaged about 150,000 people above what it was over the decade to the mid-2000s. This required the supply of an extra 50,000 new homes per year. See the next chart. Unfortunately, this was slow in coming. But with an insufficient supply response to surging demand, prices were able to stay elevated. And so poor housing affordability got locked in.

Source: ABS, AMP Capital

Each cyclical downturn in house prices has brought hope of a solution, but it was invariably dashed as the fundamental supply demand imbalance remained or re-established itself. The same looked to be applying more recently with average house prices surging 10% between June last year.

The longer-term impact of coronavirus

The coronavirus shock has the potential to change this dynamic of cyclical fluctuations around ongoing poor affordability. It has already triggered a renewed downturn in property prices with capital city prices down 2% on average since April, with Melbourne prices down around 4%. JobKeeper and the bank payment holiday are preventing faster falls at present. But further declines in national prices are likely, as high unemployment, the depressed rental market and the collapse in immigration impact. We now see average capital city prices falling 10-15% from their April high out to mid-next year with Melbourne most at risk and likely to see a 15-20% decline.

Past experience would suggest that this may be just another cyclical downturn and once coronavirus comes under control and the economy rebounds it will be back to normal with poor affordability. Particularly with record low interest rates making it feasible to borrow up big. However, the coronavirus shock has the potential to change this for three reasons.

-

First, the hit to economy from coronavirus is bigger than anything seen in the post war period. While most of the activity hit by lockdowns should bounce back once the virus is brought under control some things will take longer to recover (eg, travel & tourism), some will be permanently changed for ever (with eg, a big shift to on-line shopping, education, health care & watching sports) and businesses will use the uncertainty to accelerate cost savings. All of which will mean a long tail of unemployment. JobKeeper has shielded Australia from what otherwise would have been 15% unemployment in April and 11% unemployment now. But officially measured unemployment is still likely to hit 10% by year end and will probably have only fallen to around 9% by end 2021. This will likely result in more forced property sales and act as a drag on home prices, as income support measures & the bank payment holiday wind down.

-

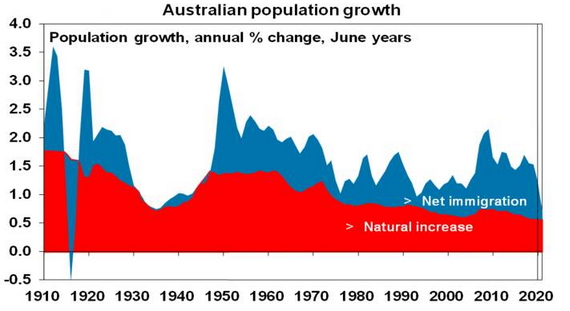

Second, immigration has been a big driver of property prices and it’s taken a huge hit and may take a long while to recover. Thanks to travel bans, net immigration is likely to have fallen to just below 170,000 in 2019-20 and to around 35,000 this financial year from 240,000 last financial year. This is a huge hit which will take population growth in 2020-21 to just 0.7%, its lowest since 1917. See next chart.This will reduce annual underlying demand for homes to around 120,000 dwellings, compared to underlying demand last year of around 200,000. This could result in a significant oversupply of dwellings, and in turn could reverse the years of undersupply that has maintained very high house prices since mid-last decade. (See the population versus dwelling completions chart above.) A big cut to immigration is not something many other countries have to deal with, so their experience is not directly translatable to Australia. Of course, if this is just for a year, it wouldn’t have much lasting impact. And the return of expat Australians may provide a short-term offset. But with unemployment likely to remain high for some time, it will be hard politically for the Government to quickly ramp up immigration to previous levels, even once it is safe to do so from a coronavirus perspective. After the early 1990s recession net immigration stayed low at around 90,000 pa until the mid-2000s. All of which points to a long period of constrained housing demand and hence more constrained house prices.

Source: ABS, AMP Capital

-

Finally, a mass shift to working from home potentially has huge implications for residential property prices. Prior to coronavirus, working from home was only slowly creeping in. Now coronavirus driven lockdowns and social distancing has shown that its feasible for most white-collar workers and can be good for productivity. Of course, full time working from home does come with costs in terms of team cohesion, corporate culture, the development of younger workers and less opportunities for spontaneously exchanging ideas. So, some sort of hybrid may become the norm – some at home all the time, some in the office all the time, but most doing half and half. And working from home works best in houses where there’s lots of room as opposed to apartments. All of which could revolutionise residential property demand – and from what I am hearing anecdotally maybe already is. Which will mean less demand for property close to the CBD, greater demand for property in suburbs, with a decent community and environment and increased property demand in regional centres. All of which could break down the dominance of the city with its expensive property. This would turn the trend of recent decades favouring more condensed living close to the city on its head. Some office property (and possibly also some retail property impacted by the shift to online retailing) could be repurposed for residential use, thereby boosting housing supply. By fostering decentralisation, a shift away from cities to regional communities could dramatically improve housing affordability over time.

Concluding comment

We are still fighting the war against coronavirus but it’s likely, as we have seen with various shocks in the past, we will get over it, and go back to something more normal. But not everything will go back to normal. A lasting impact could be more affordable housing in Australia. It’s not our base case that this will come in the form of a property crash (and that would be a bad outcome for the economy anyway via negative wealth effects) but it could come in the form of much softer property price gains over time (after the initial hit into next year).

Source: AMP Capital 12 August 2020

Important notes: While every care has been taken in the preparation of this article, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) (AMP Capital) makes no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This article has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this article, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This article is solely for the use of the party to whom it is provided and must not be provided to any other person or entity without the express written consent of AMP Capital.