The transfer of wealth and financial support from older Australians to their children and grandchildren is becoming a hot topic for families around the country.

Australians over 60 are set to transfer an estimated $3.5 trillion over the next two decades1.

And new AMP research highlights the challenges older Australians are facing about the best way to help the next generation2.

-

3 in 4 Australians aged 65+ believe it’s important to pass wealth onto their children.

-

And 4 in 5 believe their children face harder or similar financial challenges compared with them at the same age.

-

But 7 in 10 are unlikely to adjust their lifestyles to pass wealth onto their children.

-

And while 4 in 5 are not prepared to downsize to release funds to their children, almost half would consider passing home equity value on if they could stay in the family home.

Mind the (wealth) gap

Older Australians have worked hard their whole lives to build up their retirement nest egg. However, the growth in Boomers’ wealth has outpaced other generations, which has increased the wealth gap. This is largely down to a decline in interest rates as well as good luck with asset prices appreciating over the last 40 years like the family home, says AMP Deputy Chief Economist Diana Mousina.

So on one side of the wealth gap you have younger Australians trying to get a foot on the housing ladder as house prices and interest rates rise. Diana says it used to take 6 years to save for a 20% deposit whereas now it takes nearly 11. This increasing inequality is an issue because if it dampens living standards across generations it can cause resentment and social instability.

And on the other side you have older Australians who know the challenges younger family members are facing. And they’re keen to help. But they’re not confident enough about their retirement income to downsize, preferring to wait and transfer wealth in the form of an inheritance when they pass away – 90% of all intergenerational wealth transfer occurs through death inheritance3.

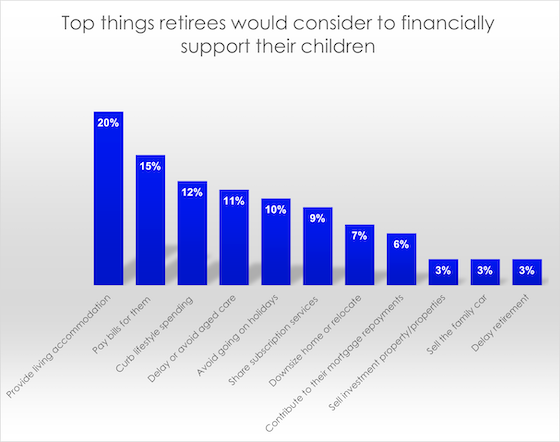

When we asked retired Australians how they might support their children financially, the most popular response (20%) was providing a place to live in the family home.

Source: AMP commissioned research

Not surprisingly, this is leading to more generations living under one roof, with Melbourne Institute4 research indicating half of Australians aged 18 to 29 are still living at home.

Reducing the wealth gap

When it comes to reducing the wealth gap, Government has a big role to play, says Diana. “What can be solved by policy is an improvement in housing affordability (and) the main policy solution to improve affordability is to increase housing supply.”

The financial services industry can also help, says AMP Director, Retirement Ben Hillier, by “providing retirees with the financial confidence that their savings will last, not only to help them live life to the fullest, but also give greater clarity with how they can help their kids.”

Ben adds, “We need to explore new ways to help retirees unlock capital from their home, without the need to downsize or compromise their long-term wellbeing”.

Quick wealth tips for over 50s…

-

Still working? Speak to us about a check-in for your super.

-

Planning for retirement? Find out when you can access your super.

-

Get ready for life after work with our handy 7-point guide.

-

Need some advice? Speak to us, we can step you through the tax, income and pension minefields in retirement.

-

Thinking about downsizing? Whether it’s a smaller apartment with in-home care, a retirement village or an aged care facility, it’s worth planning ahead to make sure you choose the right living option.

…and under 50 Millennials and Gen Z

Learn how to manage your money and understand where it goes by creating a budget.

Break down your income and expenses with a budget planner calculator.

Set-up and kick your savings goals with these 9 money tips.

Get money smart.

-

Looking for simple, fast and accessible info? Your super fund can help you understand more about how the choices you make now can have a real impact on your financial future.

-

Looking for more personal advice? You might like to speak to us, we can assess your circumstances, develop a detailed strategy and provide ongoing advice as your life changes.

1,3 Wealth transfers and their economic effects. Australian Government Productivity Commission, 7 December 2021.

2 AMP commissioned Dynata in February 2024 to conduct a survey of 2000 Australians aged 50 years and over and 30 years and under in relation to their attitudes to retirement and intergenerational wealth transferral.

4 More Australian adult children and living with their parents longer. Melbourne Institute, Hilda Survey.

Source: AMP June 2024

Important:

This information is provided by AMP Life Limited. It is general information only and hasn’t taken your circumstances into account. It’s important to consider your particular circumstances and the relevant Product Disclosure Statement or Terms and Conditions, available by calling Phone 07 4054 9400, before deciding what’s right for you.

All information in this article is subject to change without notice. Although the information is from sources considered reliable, AMP and our company do not guarantee that it is accurate or complete. You should not rely upon it and should seek professional advice before making any financial decision. Except where liability under any statute cannot be excluded, AMP and our company do not accept any liability for any resulting loss or damage of the reader or any other person. Any links have been provided for information purposes only and will take you to external websites. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.